Introduction To Insurance Basics

Today, We want to share with you Introduction To Insurance Basics.

In this post we will show you INSURANCE BASICS, hear for what is insurance policy,type of insurance we will give you demo and example for implement.

In this post, we will learn about insurance meaning and types with an example.

INTRODUCTION About INSURANCE BASICS

what is insurance policy

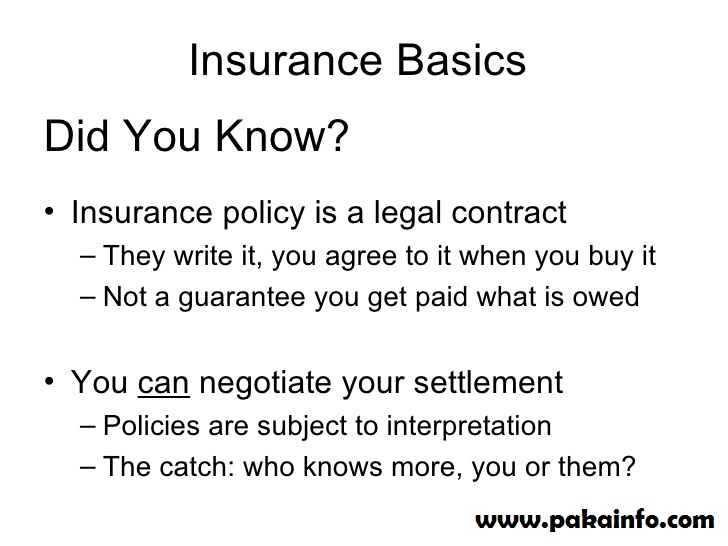

An insurance policy a simple All The legal document Information the terms privacy and conditions of a both person agree with this contract of insurance.

Type of insurance

The following are Type of insurance:

- Fire Insurance.

- Guarantee Insurance.

- Liability Insurance.

- Life Insurance

- Marine Insurance.

- Personal Insurance.

- Property Insurance.

- Social Insurance.

insurance meaning and types

An Insurance is a simple meaning of All type of the protection / security from All type of the financial loss.

The following 4 Types Of Insurance Everyone Person Needs Like As a Life Insurance, Long-Term Disability Coverage, Health Insurance, Auto Insurance, Insurance meaning and types

how many types of insurance

The following are 9 Type of insurance:

- Health Insurance

- Auto Insurance

- Life Insurance

- Dental Insurance

- Travel Insurance

- Pet Insurance

- Homeowners Insurance

- Unemployment Insurance

- Business Insurance

A simple Car insurance is generally a All the contract between a peoples/customer and your an Main Stage insurance company.The following are the Types of car insurance policies.

- Third-party liability insurance

- Comprehensive car insurance

Advantages of Insurance

The following are the advantages of insurance:

- Providing Security

- Covers Business Property

- Tax Benefits

- Spreading of Risk

- Source for Collecting Funds

- Encourage Savings

- Encourage International Trade

- Protects Against Liabilities

- Replaces Income

Disadvantages of Insurance

The following are the Disadvantages of insurance:

- Adds Expense

- Pays Slowly

- Tricky terms and conditions

- Lengthy legal formalities

- Denies Claims

- Potential crime incidents

What is insurance?

Read :

Summary

You can also read about AngularJS, ASP.NET, VueJs, PHP.

I hope you get an idea about Introduction to Insurance Basics with types.

I would like to have feedback on my Pakainfo.com blog.

Your valuable feedback, question, or comments about this article are always welcome.

If you enjoyed and liked this post, don’t forget to share.