MPIN Full Form – What Is MPIN, Definition, Meaning, Uses & Understand how to get MPIN in simple language.

Technology and the Internet have made our lives a lot easier. It cannot be ignored that the development of technology has taken away employment from many people but it has also made the everyday life of the people very easy. The banking sector has also progressed a lot in the last few years.

Now you can do all the banking related work sitting at home from your phone. But for this MPIN is required. Do you know what is MPIN (mpin means) and MPIN Full Form? If not, then read this article till the end.

Ever since the introduction of Mobile Banking, the name MPIN has also come into vogue. Some people consider it as ATM PIN and some consider it as UPI PIN only. But there is nothing like this, MPN is different from these two.

Although it can also be considered as a password in a way, but it cannot be matched with your mobile password or any kind of App Lock Password. In today’s article we are going to talk about MPIN.

Today we will know what is mpin full form and what is the meaning of MPIN (MPIN Meaning)? So Let’s Begin!

MPIN Full Form – What Is MPIN, Definition, Meaning, Uses

mpin full form is :

mPIN stands for Mobile Banking Personal Identification Number.

To understand MPIN & mpin full form, first of all it is very important to know its full form. The full form of MPIN is ‘Mobile Banking Personal Identification Number’. Mobile Banking Personal Identification Number can be called ‘Mobile Banking Personal Identification Number’ in Hindi. In simple language, it is such a number that identifies the user in mobile banking.

Use Of MPIN:

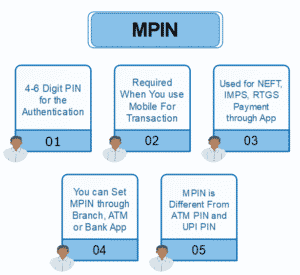

- IMPS / NEFT / RTGS

- IVR

- Mobile App Banking

- SMS banking

- UPI apps

- USSD banking

What is MPIN? – mpin full form

mpin full form – MPIN: Mobile Banking Personal Identification Number

- MPIN’s full form Mobile Banking Personal Identification Number only tells what it is.

- This is a kind of number that identifies the user using Mobile Banking.

- It is in a way a password that is required to use Mobile Banking.

- It is mainly number 4 but the MPIN of some banks’ services can be up to 6 numbers.

- People often misunderstand MPIN as an ATM PIN, but there is nothing like it.

- MPIN is necessary so that no other person can use your mobile banking services. Nowadays, lakhs of rupees can be transferred from mobile itself, in such a situation its security is also very important. MPIN is only a small part of it.

- No person can use your Mobile Banking Services without your MPIN.

MPIN is a kind of security code for mobile banking which should be kept secret.

mpin full form is Mobile Banking Personal Identification Number is given at the time of registering for Mobile Banking Services, which is set by the user himself. Whenever the user has to take advantage of the mobile banking facility, then only through this MPIN is entered in the mobile banking apps.

It is demanded at the time of any kind of transaction. With this, Mobile Banking remains secure.

What is the MPIN and how can I receive it?

- Branches of the Bank

- ATM (Automatic Teller Machine)

- On the internet

- Visiting a Bank Branch

Different Ways to Generate mPIN Online

The Different Ways to Generate MPIN Online are as follows:

- By using ATM Card

- Using Bank Branch

- Using Net Banking

- Using UPI Apps

- Using USSD Code

Importance of MPIN

Technology has progressed very fast regarding the work related to banking. In the last few years, technology has made a lot of progress in the field of banking. We can do transactions of lakhs while sitting at home through Mobile Banking, but in the meantime cybercrime has also increased a lot.

Cyber Crime has gone to such an extent that within a few minutes your hard earned money can disappear from your bank account. In such a situation mpin full form, security is very important.

This is the reason why RBI has made Two-Way Authentication mandatory for mobile banking. Under this, Registered Number and MPIN are necessary for Mobile Banking.

Just as ATM Card and ATM Pin are necessary for any transaction related to ATM, in the same way Registered Mobile Number and MPIN are necessary to avail the facilities related to Mobile Banking.

You will remember that whenever you do a transaction, an OTP comes on your registered mobile number. The transaction is successful only after this OTP is entered. With this, you remain safe because unless a person has your mobile number, he will not be able to do any transaction through your mobile banking.

But imagine if your phone is lost and it is in the hands of a wrong person, then he has your mobile number and your phone too.

In such a situation, he can rob you of your money by opening the Mobile Banking App on your phone.

In such situations, MPIN is useful only to keep the customers safe. Because until a person does not know your MPIN, then he will not be able to do the transaction.

Hope you now understand the importance of MPIN.

How to Get MPIN?

MPIN is required for mobile banking. If you want to take advantage of the mobile banking facilities of your bank, then you must have an MPIN for that. Because without MPIN any kind of transaction cannot be done. There can be 3 ways to get the MPIN:

#1. Online: Many banks provide the option to generate MPIN online. If you wish, you can get your MPIN online. For this you have to use Bank’s Internet Services.

#2. ATM: If you want, you can also create your MPIN through ATM. For this, you have to go to the ATM and enter the Debit Card and select the option of Mobile Banking. There you will also get the option of MPIN, from which you can change and generate your MPIN.

#3. Bank Branch: Although in today’s time all the necessary work is done through internet banking and mobile banking, but still for some work one has to go to the bank branch. If you are thinking of starting the facility of mobile banking, then for that you can complete the process by visiting the bank branch and in the next few hours your mobile banking facility will start. Along with this, you will also be given MPIN.

There must be a question in the mind of many people that what will happen if we forget our MPIN? In such situations, you do not need to fear because you can easily reset MPIN through ATM or through your Mobile Banking App. You can choose the MPIN of your choice, which is easy for you to remember & learn to mpin full form.

Differences between UPI PIN, ATM PIN, and mPIN & mpin full form

| Parameter | UPI PIN | ATM PIN | mPIN |

| Uses | To authenticate transactions in UPI apps | To authenticate debit cards while withdrawing cash from ATMs or during POS transactions | To authorize mobile banking transactions through the bank app like IMPS and NEFT |

| How to set the PIN | Via the UPI app | Via the steps given by the bank to start using the debit card | Via the bank’s app |

| Length of code | May be 4 or 6 digits | 4 digit | May be 4 or 6 digits |

| Use cases | To make both online and offline transactions, check account balance via the UPI app, etc. | To withdraw cash from the ATM or check the balance | To transact via the bank’s app or to use their mobile banking services |

| How to change/reset the PIN | Via the UPI app only | By visiting the ATM or using the net banking account | Via the banking app, ATM machine, or by visiting the nearby branch |

FAQs – mPIN: Full Form, Meaning, Steps to Generate, and More

- How can I change my mPIN?

- How do I find mPIN?

- What is 4-digit mPIN number?

- What is the mPIN number?

- What should I do if I forgot my mPIN?

This was our today’s post ‘What is MPIN?’, mpin full form and how to get MPIN (How to get MPIN) Hope this post with MPIN meaning was helpful for you. If you have any question related to MPIN then you can ask us by commenting below. If you liked the mpin full form post then do share it with your friends. Thank you